Business Formation in Dominican Republic

Foreign Nationals can set up a Dominican company whether they have residency status or not. The type of entity registered will depend on the activity the business will be dedicated to carrying out, the amount of capital it will start out with and the amount of shareholders on the board. We can provide assistance with […]

Bank Account Setup in Dominican Republic

Foreign Nationals can set up accounts with Dominican banks even without holding residency status. By providing the required documentation and presenting a valid passport, an account can be set up within days. There are banks that can set up accounts within 72 hours of receiving the required documents. Important fact, foreign nationals that are in […]

Dominican Permanent Residency Renewal

The Permanent Residency is renewable every four years and requires a medical exam. To initiate the renewal process, send a copy of the picture page of your passport, copy of your residency card and cedula (front and back) along with your solvency documents. We will then schedule the medical appointment through Immigration. Allow at least […]

Investment Residency (Fast track permanent residency)

In 2007 a formal law was created incorporating a new incentive for Investors. This law stipulates that foreign nationals meeting certain criteria can obtain permanent residency through Immigration’s Investment Department and enjoy the incentives afforded by this category of residency. Who qualifies for the fast track residency? What incentives does Fast Track Residency provide? Requirements […]

Tourist Card in Dominican Republic

The foreign national must initiate the process to extend their stay in the country 15 days prior to the expiration date that appears on the tourist card. You will be required to provide: The cost of the extension is RD$2,500.00. To complete the process, visit this link.

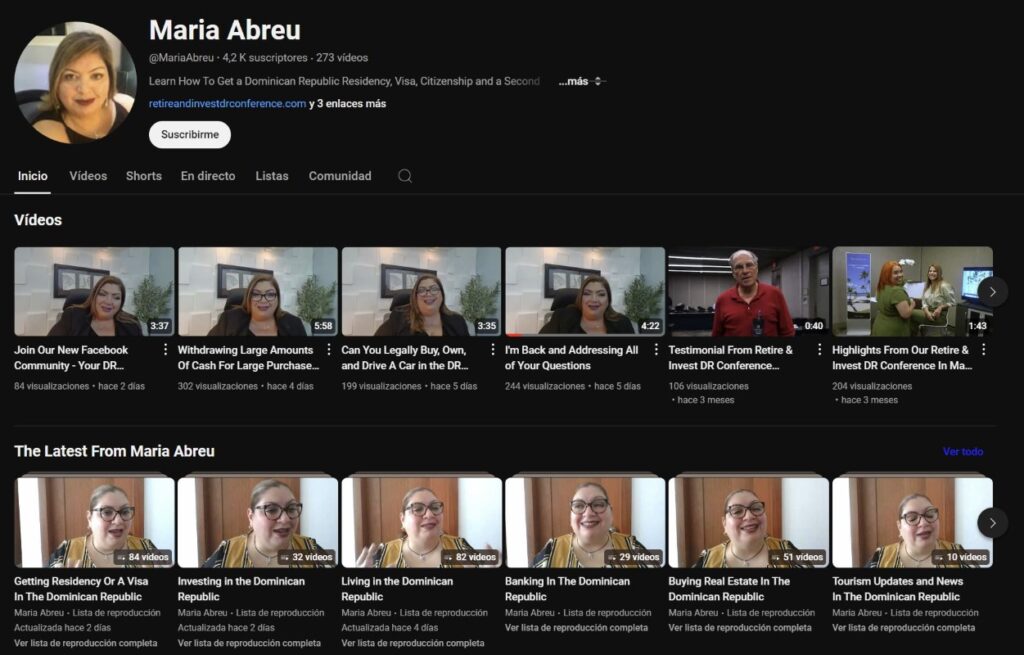

Banking In The Dominican Republic

Expats considering investing or relocating abroad often inquire about the banking system and investments in the Dominican Republic. Below is a list of frequently asked questions and answers that we hope you will find useful. For specific inquiries, Click Here to contact us directly, and we will be happy to address any questions you may have. Can […]

Dominican Republic University Education

The Great American Dream is that each future generation has the opportunity for a better life than their parents and grandparents. And part of that upward climb to increased prosperity has included the attainment of higher education for your children and grandchildren. But what if higher education suddenly became so costly that only the wealthy […]

Are you Dominican looking for American visa Residency Services?

In order to apply for a residency visa, the following documents are required: Additional documentation may be required once the file advances in stages. To apply for a tourist visa : Evidence of your employment and/or your family ties may be sufficient to show the purpose of your trip and your intent to return to your home country. If […]

What you should know about Dominican Citizenship

In light of the changes that have come about with the new immigration regulation, some have sought to establish citizenship in the Dominican Republic. However, the changes in the regulation affect the time frame that makes citizenship possible. In order to qualify for citizenship, the foreign national must meet one of the following qualifications or […]

Investment Residency Renewal (Fast Track)

Residency renewal under the investment program also known as fast track residency must be done after the first year and every two years thereafter. The process should be initiated forty-five days prior to the expiration date that appears on the residency card. REQUIREMENTS: Immigration is requiring to show sufficient movement in your Dominican bank account […]